Miscellaneous Cash |

The Miscellaneous Cash checkbox indicates whether or not the payment is directly related to your accounts receivable. Posting to miscellaneous cash allows you to record the payment without posting to a customer account as well as recording the G/L account to be associated with the payment. Miscellaneous Cash entries will be included on the Cash Journal and Cash Listing for the period the entry was made. Also See Related Topics.

Miscellaneous Cash Examples: Tax refunds, vendor rebates and cash sale of old assets can be entered as Miscellaneous Cash.

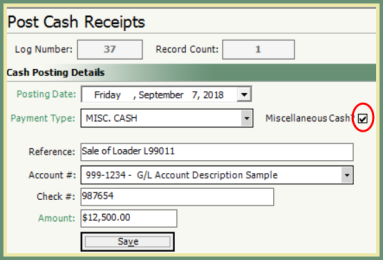

Navigate To: Accounting>Cash Receipts>Post Cash Receipts

Miscellaneous Cash

- Check Miscellaneous Cash box.

.

.

- Enter Posting Date.

- Select Payment Type from drop down.

- Enter Reference.

- Select G/L Account #.

- Enter Check # or Payment Reference.

- Enter Amount.

- Save.

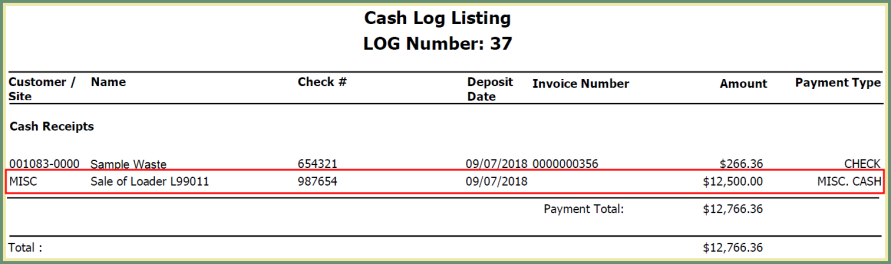

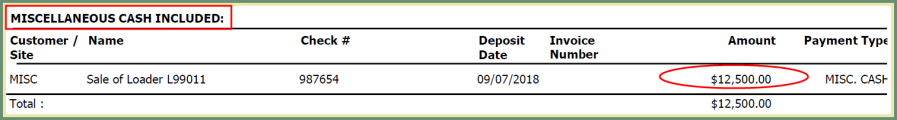

- Preview Log and/or Print & Clear . Miscellaneous Cash will add to the same Log as Post Cash Receipts to Customer Accounts. Miscellaneous entries will be indicated in the Miscellaneous Cash Included section of the Log.