G/L Accounts and Details Export |

|

Define all of the General Ledger Account codes that you want to use when posting accounting information from TRUX into your General Ledger. These General Ledger accounts can be easily mapped to customer and service types within G/L Details Export. The G/L Details Export can then be exported by specified criteria as a .csv which allows you to apply filters according to your company needs. G/L Revenue is a simplified report of G/L accounts in a summary only format.

Create all of your company G/L Accounts to be applied to period charges, activities, materials, taxes, miscellaneous, payments and adjustments.

Navigate To: System >Configuration>Code Maintenance>Accounting>General Ledger Accounts

- Enter a unique G/L Account Number.

- Enter a unique Description.

- Repeat for all General Ledger Accounts.

- Click Save.

- General Ledger Accounts cannot be deleted but can be set as inactive by removing the active checkbox.

- Inactive general ledger accounts will be displayed in red.

In a simplified table, you can associate each of your defined record type/code/service type/customer type to a single G/L Account.

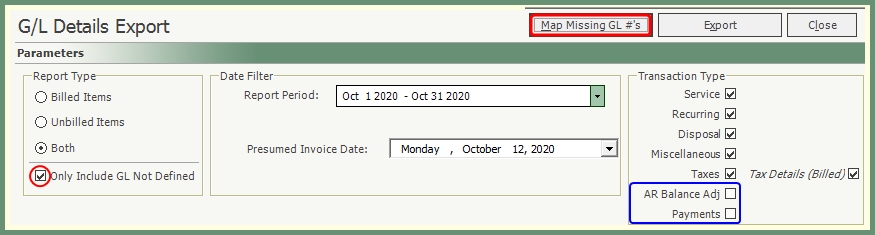

Navigate To: Accounting>G/L Details Export

|

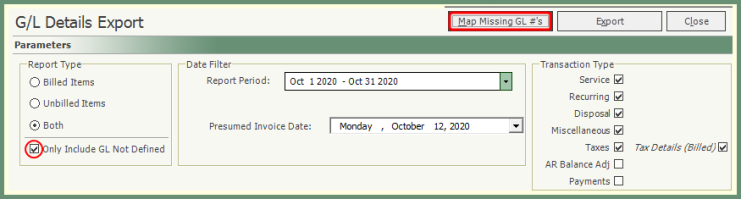

-

For mapping all Record Type combinations to a G/L Account, select Both.

-

Check Only Include GL Not Defined.

-

To only include billable records, remove AR Balance Adj. and Payments Transaction

-

Click Map Missing GL#'s.

-

All unmapped record types within the report period for the selected transaction types will populate the Unmapped Combinations grid.

-

Sort the grid by Record Type, Code or Service Type.

-

Click the G/L Code drop down to apply a G/L Account.

-

Repeat for all unmapped record type combinations and Save.

The main detailed reporting tool for revenue by G/L account. Exporting the details to excel allows for a full data dump to apply data filters within excel for G/L reporting for your specific accounting needs. See the Sample G/L Export.

Navigate To: Accounting>G/L Details Export

-

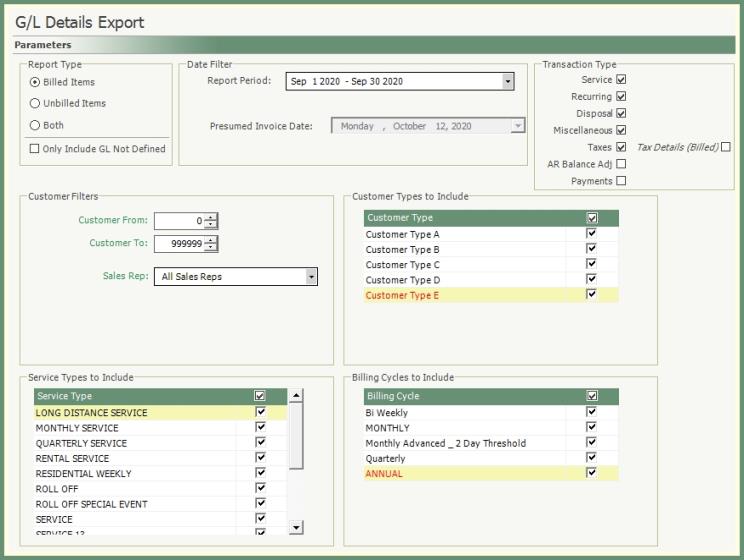

Select a Report Type.

|

Billed: Only billed line items within the Report Period will be considered. Unbilled: Only unbilled line items within the Presumed Invoice Date will be considered. Both: Includes billed and unbilled line items within the Report Period and Presumed Invoice Date will be considered. |

-

Select a Report Period for Billed or Both Report Type. For more information on setting up the Period End Timetable, Period End Timetable.

-

Select a Presumed Invoice Date for Unbilled or Both Report Type.

-

Unbilled items up to and including the presumed invoice date will be considered in the export.

-

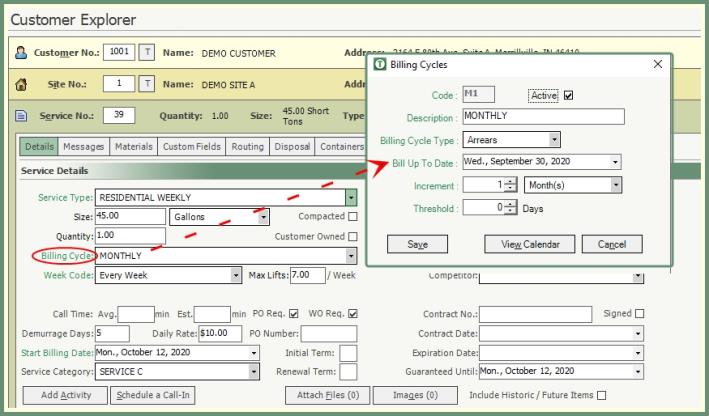

Presumed invoice date will be compared against the date of the unbilled line item and the .

-

Review and include/exclude the transaction types to be considered in the export.

-

Typical month-end transaction types include all transaction types except for AR Balance Adj. & Payments.

-

Review and apply Customer Filters, Sales Representatives, Customer Types, Service Types and Billing Cycles.

-

Typical month-end reporting includes the default (All) customers, sales reps, customer types, service types and billing cycles.

-

Click Export.

-

Navigate to save file location, enter file name and save.

-

Recall the saved .csv in excel and filter as per your preferences.

-

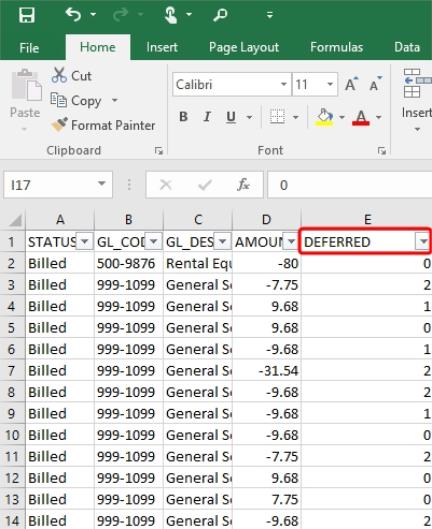

See Deferred Codes to apply filters to earned, deferred or reverse deferred revenue.

|

|

G/L Details Export Deferred Codes:

The number in the Deferred Column indicates the Revenue is: 0=Earned

1=Deferred

2=Reversed Deferred |

A simplified G/L revenue report summarized by period, customer, billing cycle and/or customer type. For a detailed report, use G/L_Details_Export.

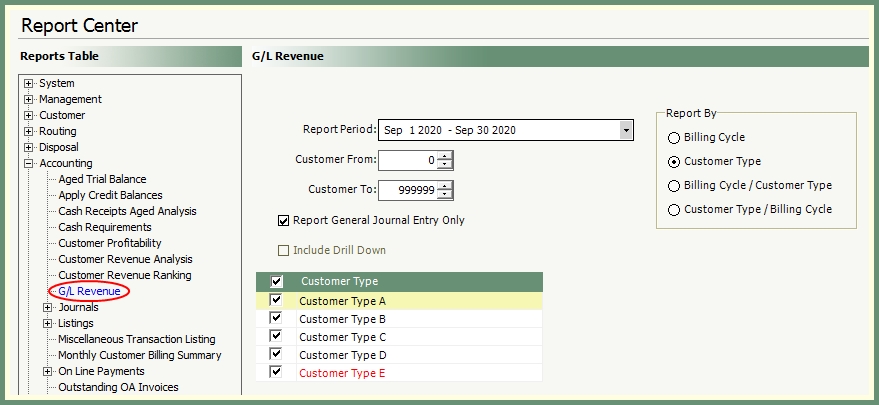

Navigate To: Report>Report Center>Accounting>G/L Revenue

-

Select a Report Period. For more information on setting up the Period End Timetable, Period End Timetable.

-

Enter customer range if you are not reporting on all customers (default).

-

Select Report By option (Billing Cycle, Customer Type or Both).

-

Grid will display based on the Report By selection.

-

Populate grid according to the billing cycle or customer types to be included.

-

Report options Report General Journal Entry Only or Include Drill Down .

-

Select an output.

|

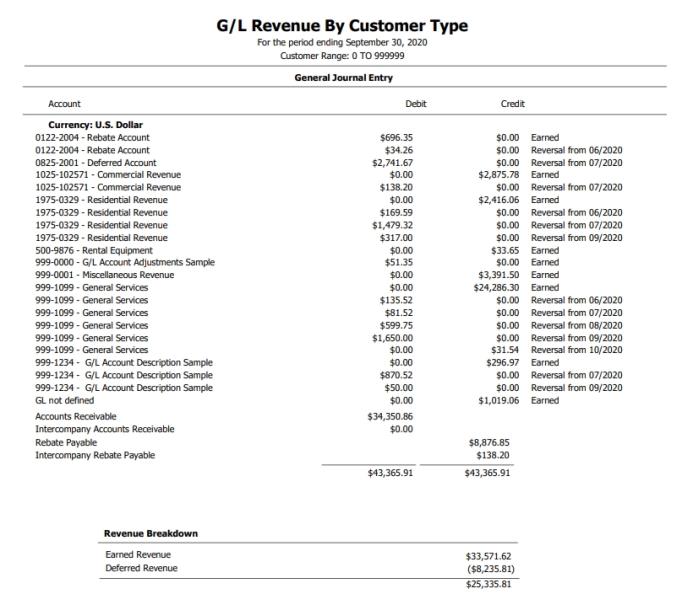

Revenue Report By General Journal Entry

|

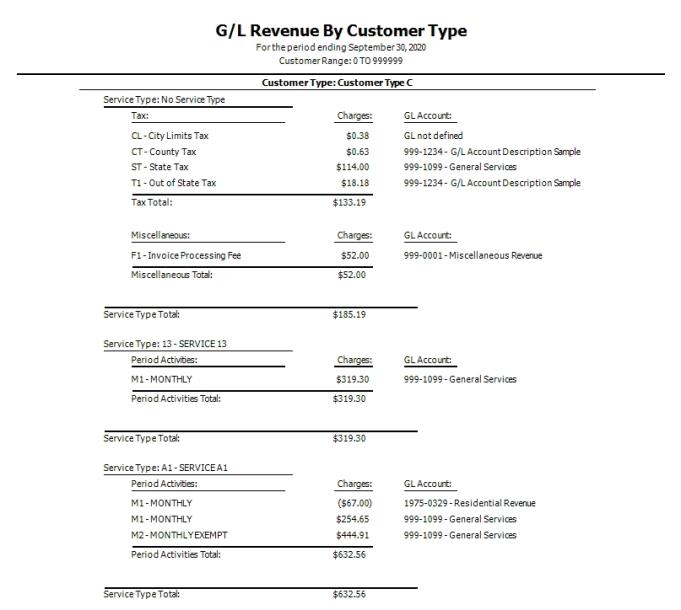

Revenue Report With Drill Down

|