Account Inquiry Adjustments

Adjustments can be applied directly to a Customer Account or Customer Invoice in Account Inquiry. There's two types of Adjustments available; Invoice Detail Adjustment and AR Balance Adjustment. The differences are shown in the below table. This document will take you through the steps to post both types of adjustments though Account Inquiry.

This document will take you through the steps to post an AR Balance Adjustment and Invoice Detail Adjustment from Account Inquiry and illustrate the end results on the Customer Invoice, AR Balance Adjustment Reporting, Invoice Detail Adjustment Reporting , as well as include an optional GL Account selection on adjustments.

|

Invoice Detail Adjustment (Sales Adjustment) |

AR Balance Adjustment

|

|

|---|---|---|

| Impacts Sales Journal and GL |

Yes |

No |

| Impacts Adjustment Journal | No | Yes |

| Impact on Invoice | Will Show in Invoice Body - Dependent on Credit Memo | Will Show in Accounts Receivable Summary |

| Controlled by Approval Process | Yes | Yes |

| Will Recalculate Tax | Yes | No |

| Will Recalculate Surcharge | Yes | No |

| Adjustment Date Control or Impact Period | System Will Impact Current Period | User Can Select Date |

To Navigate To Account Inquiry, Go To: Account Inquiry Navigation

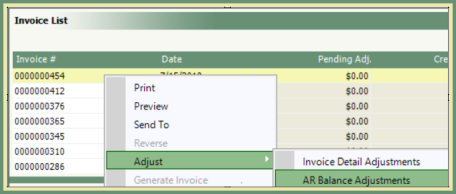

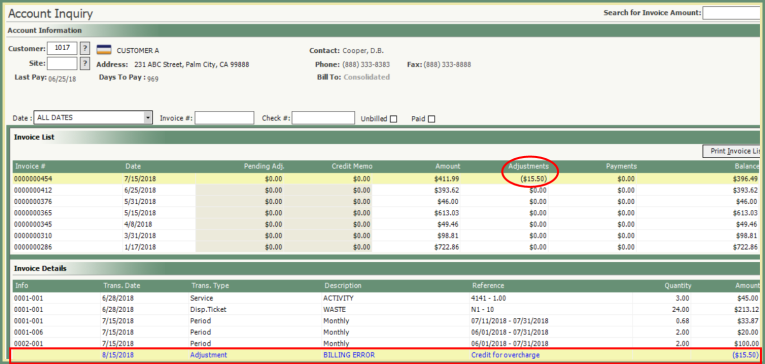

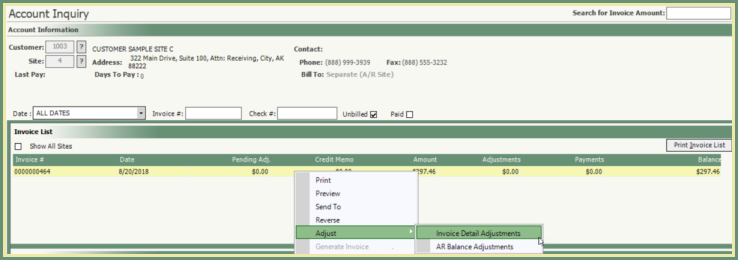

- Enter or Search Customer/Site number OR Enter Invoice number to be adjusted in the Invoice # field.

- In the Invoice List, right click on the Invoice to be adjusted.

- Select Adjust>AR Balance Adjustments.

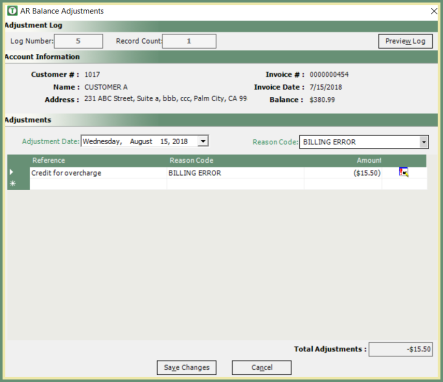

- Select the Adjustment Date and Reason Code from the drop down menu.

- Enter Reference (optional, but recommended for future reference).

- Reason Code will default to the Reason Code selected.

- Enter adjustment amount as positive or negative.

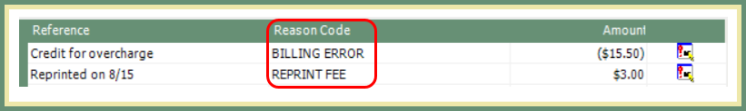

- If multiple adjustments are being entered, repeat steps 5-7. Reason Code can be changed for each adjustment line item.

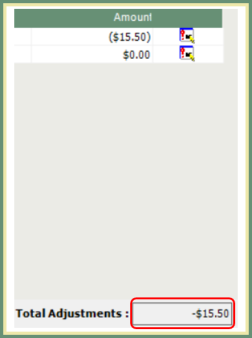

- Verify Total Adjustments.

- Save Changes.

AR Balance Adjustments with General Ledger Accounts

AR Balance Adjustments have the option to Enforce GL Account on Adjustments. Utilizing this function will force the user to make a GL Account selection for all AR Balance Adjustments. Click the above link for setup instructions.

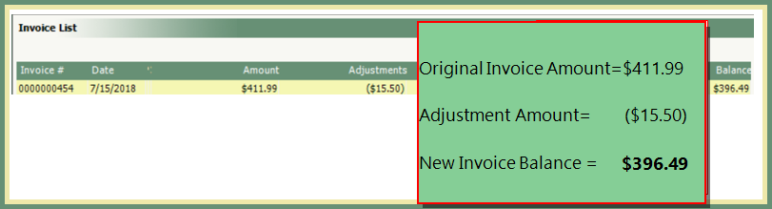

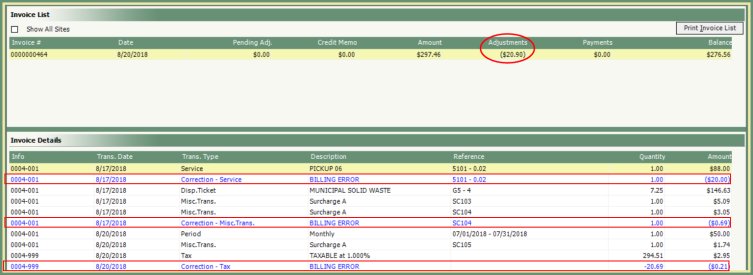

- AR Balance Adjustment will now display the adjustment in the Adjustment column and invoice balance will reflect the adjusted amount. See below.

- The Invoice Details will display the adjustment date, transaction type=Adjustment, adjustment reason, reference and amount. See below.

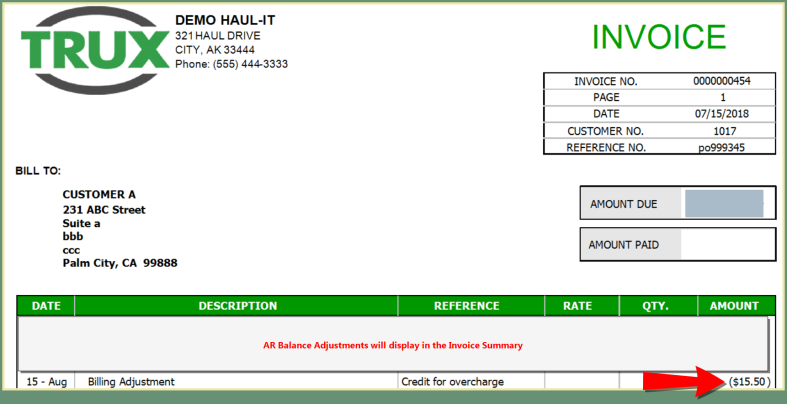

AR Balance Adjustment will be included in the Invoice Summary.

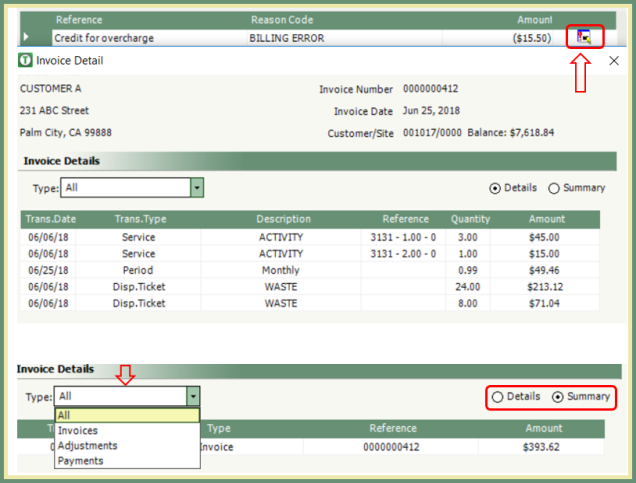

- To the right of the amount field, click the Invoice Details tool tip.

- Invoice Details can be displayed in Detail or Summary. Default is Detail. Click the Summary radio button to display in Summary.

- Invoice Detail Type can display All, Invoice, Adjustments or Payments. The default is All. Click on the Type drop down to change the display.

AR Balance Adjustment Reporting

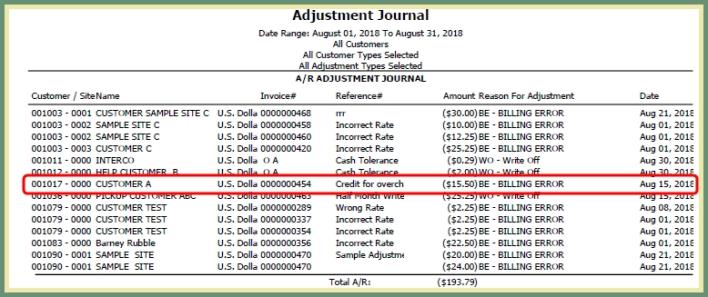

Adjustment Journal

Navigate: Report>Accounting>Journals>Adjustment Journal

- Adjustment Journal is run for a Billing Period.

- Adjustments posted during the reported Billing Period will be included.

- Adjustments entered through Account Inquiry are included on the Adjustment Journal along with Adjustments entered through Post Adjustments and Batch Post Adjustments.

- The below Adjustment Journal sample is presented in Detail.

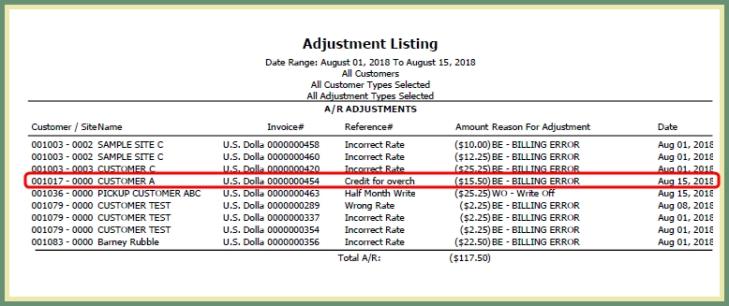

Adjustment Listing

Navigate: Report>Accounting>Listing>Adjustment Listing

- Adjustment Listing is run for a Date Range.

- Adjustments posted during the selected date range will be included.

- Adjustments entered through Account Inquiry are included on the Adjustment Listing along with Adjustments entered through Post Adjustments and Batch Post Adjustments.

- The below Adjustment Listing sample is presented in Detail.

- Enter or Search Customer/Site number OR Enter Invoice number to be adjusted in the Invoice # field.

- In the Invoice List, right click on the Invoice to be adjusted.

- Select Adjustment>Invoice Detail Adjustments

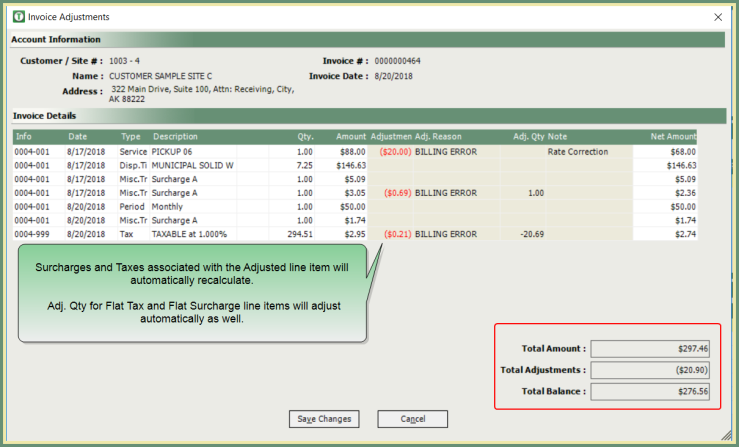

- Invoice Adjustments window will open. Each line item contained on the invoice will be listed in the Invoice Details grid.

- Click in the Adjustments field beside the line item to be adjusted. Click Me For A Tip!

- Enter the Adjustment amount as positive or negative.

- Select and Adj. Reason from the drop down menu.

- *Adj. Qty is only applied when Flat Tax or Flat Surcharge exists on an Invoice. The value for this field will default only when Flat Tax or Flat Surcharge exists but can be changed by the user if needed.

- Note field entry is optional, but recommended for future reference.

- Verify the Total Adjustments and Total Balance.

- Save Changes.

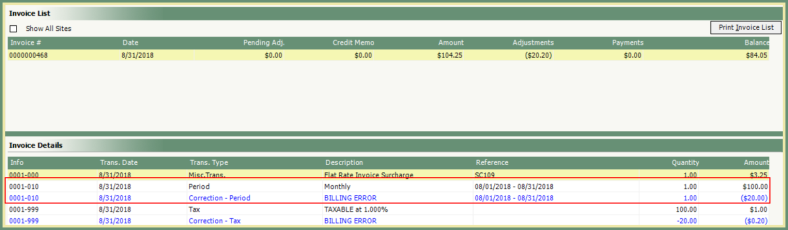

Account Inquiry

- Invoice List will display the Adjustment amount and the Balance will reflect the adjustment amount.

- Invoice Details will display each Invoice Detail Adjustment line item.

Invoice

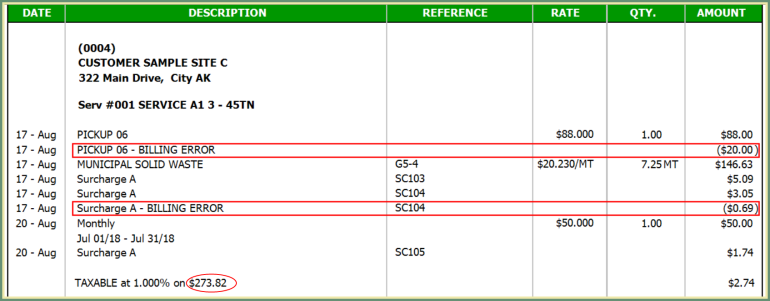

- If Credit Memo's are NOT utilized, the Invoice Detail Adjustments are displayed in the body of the invoice below the adjusted line item.

- The Tax is now calculated on the new invoice balance.

Invoice Detail Adjustment Reporting

Sales Journal

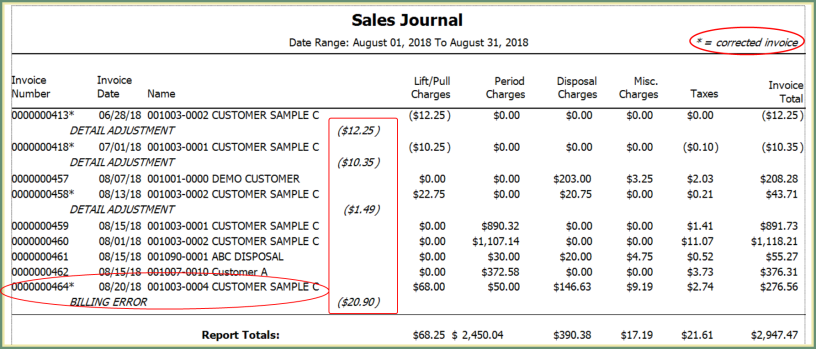

- Sales Journal will include all Invoice Detail Adjustments posted for the period reported.

- Corrected Invoices include an asterisk(*) after the Invoice Number.

- Adjustment reason and amount will be listed below the Invoice.

- Invoice Total will reflect the invoice detail adjustments.

The below example is displayed in Detail

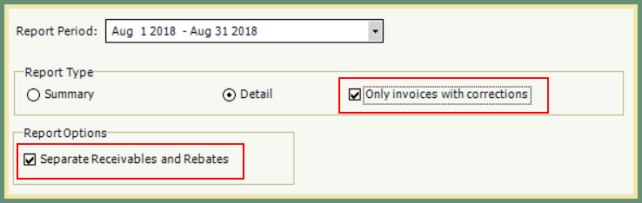

- When the Sales Journal is run in Summary or Detail, there is an option to Separate Receivables and Rebates. This option will report Receivables and Rebates in separate groups.

- When the Sales Journal is run in Detail, there is an option to report Only invoices with corrections. This option will only report invoices that include and Invoice Detail Adjustment.

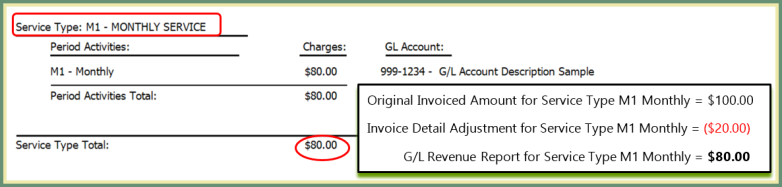

G/L Revenue

- G/L Revenue includes Invoice Detail Adjustments in the Charges.

See the below example for Service Type M1 - Monthly Service:

Account Inquiry Account History